As we start week 4, at least in Virginia of the Coronavirus shutdown, I find myself when I finally slowdown on the weekends pondering just how surreal this all is. Here are some of the random thoughts I had over the weekend.

- It seems Zoom was in the right place at the right time. It's easier to use than nearly all other platforms out there, which made it perfect for teachers, pastors, and traditional financial advisors to use when suddenly they had to do things virtually. Despite warnings about security risks I continue to be invited to meetings without passwords and have had several recorded that didn't need to be recorded. Please be careful what you share on these meetings and if you're hosting a meeting, here are some tips you should follow.....and ask yourself, a.) does this really need recorded and b.) if so, where am I going to store the video.

- I think we are all learning what is really important and I hope this carries into our lives when things begin to recover.

- Speaking of what's important, I think we all have things we've been wasting money on. Now's a good time to work on your "recovery" budget. Regardless of your situation the "solutions" are going to lead to slower economic growth, significantly higher taxes, and likely more strict credit requirements. We have some tools at WhatsMyScore.net that can help you out.

- We may be settling into a bit of a groove. We finally sat down last weekend and made a spreadsheet of the wide-range of work that has been assigned to our 13-year old twins. They are taking the same classes, but have different teachers for most. Kudos to those teachers who have gone above and beyond. As a parent I think we all appreciate teachers more and we can really see the passion some teachers have for teaching their students. Given our long hours and with all of our non-family member staff in Virginia staying home for various reasons, our office has become our second home. We didn't realize it at the time, but we had already socially distanced our desks with the twins taking over a few of the open desks we had.

- I find myself getting more and more angry at the investment advice I'm hearing on TV. It is misguided and dangerous. These same people calling this a "buying opportunity" have also advocated even when stocks were clearly in a bubble to "buy & hold". If you're always invested, how can you buy when stocks go down?

- If you’re an advisor, your job is not to be a market cheerleader. You need to set proper expectations. If you believe today’s prices in stocks are a buying opportunity, you are betting all of your clients money on a “V-bottom” in earnings and the economy. I hope that is the case, but I’d hate to make that bet. We are seeing some nice opportunities developing. I took a deep dive at the indicators you can use to properly set expectations with clients (and hopefully adjust your allocations.) You owe it to your clients to look at all the data, not just those that confirm your “buying opportunity” thesis. Hope is not a strategy. As we say around our office, “hope for the best, plan for the worst.”

- Speaking of bad advice -- are you going to listen to the Wall Street firms calling for a "V-bottom" in the economy where the assumption is everything rockets back to "normal" or the medical professionals who see this as a problem likely until Spring 2021 when we finally have a full vaccine and enough supplies to do thorough testing?

- I do expect a very big rally in stocks when we see the curve "flatten". However, after that the economic reality will set in and we'll likely see at minimum a retest of the lows and possibly some very scary new lows.

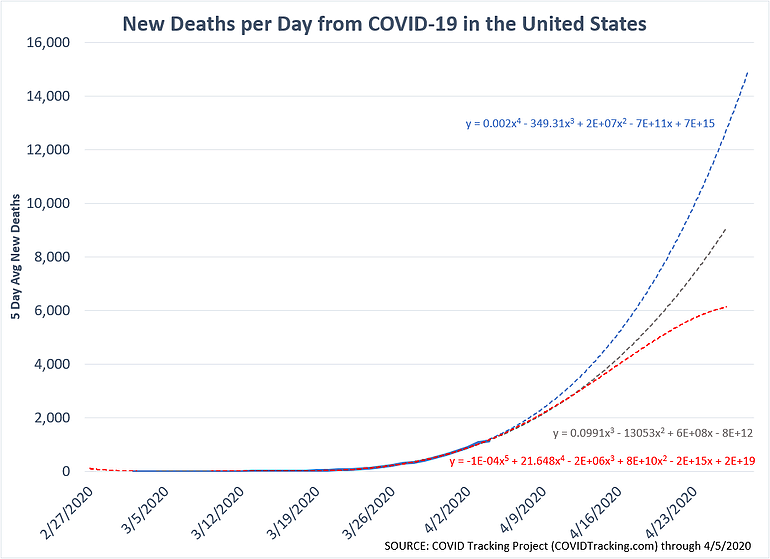

- On that note, I updated the charts in "Worse Before It Gets Better". The number of new deaths per day did appear to level off the last few days. Hopefully we continue this trend.

- Most people reading this blog are going through a completely different experience than most of the country. A few years ago, less than half of the Babyboom generation had saved $100K for retirement. 40% of Americans couldn't come up with $500 in case of an emergency. Most of us, however did have a time in our lives where we lived paycheck to paycheck. We all have different experiences and try to remember a time when we couldn't afford to lose our jobs with little chance of working again for 2-3 months.

- Keeping that in mind, there are a lot of people out there receiving stimulus checks who don’t need them - people who haven’t lost their jobs, people on government pensions, people on Social Security. There are many people who’s stimulus check won’t be enough. For many small businesses the help won’t come fast enough or be enough.In the rush to draft the 800 page legislation the Senate didn’t do enough for those most impacted.Keep that in mind. If you still have close to the same amount of income coming in, find a way to make a difference with your stimulus check.

- I said this last week, but continue to hear even Christians misunderstanding this pandemic -- This is not from God. "The whole world lies in the power or the evil one." God made it clear it was from Him and brought the various plagues to Egypt for a specific purpose. He has not made it clear this was from Him, so we should treat this like it is from Satan. This doesn't mean God can't play a key role in the healing for our nation and change things for the better going forward.

- One of the awesome things I'm seeing is how many churches have been able to go online and reach more people. Our former church in Tucson had resisted this because they did not want to create something that would allow people to stay home. We need people and being in a physical church is key to making a bigger impact for God and strengthening our relationship. Thanks to Arizona issuing stay-at-home orders, we were able to "visit" our old church online yesterday. One thing he made clear -- we need to know the difference between a problem and an annoyance. There are many people who have serious problems because of the coronavirus. Those who are only experiencing annoyances need to help them.

- One way to make a bigger difference is through our Cornerstone Portfolios.

- I want to expand on this thought further, but while working in the yard on Saturday I found a parallel between investors and advisors who "do it themselves" instead of hiring professionals. Being from Arizona we know little about growing grass. Our new house in Virginia has about an acre of cleared land where we decided to plant grass. We had tried two different "highly recommended" landscapers to put in the yard and maintain it. Being in the midst of an economic bubble, the service was poor and we weren't happy. Last fall, after seeing our yard more weeds than grass, we decided to do the research and start over.

The twins and I spent several hours every night after work/school for a month preparing the ground and re-seeding it. It survived the winter and we are entering a new season, which requires new research. I misread the emergence of a plant as crabgrass and rushed to treat it with per-emergent crabgrass killer. Turns out it was "quack-grass", which will eventually be eradicated with a thick lawn. The problem now is the crabgrass killer likely also killed the seeds we still had in the ground, which would have helped thicken the lawn. The summer will bring new issues I've never dealt with as will the fall. We'll have heavy rains, droughts, heat waves, and all kinds of things I've never had to deal with. In addition, I'm likely to get busy with work and neglect the grass. At some point I'll need to decide if it would be better to hire a professional (especially now that the economy is weak and we're likely to get better service.)

For now, the twins have been charged with keeping up with everything. They have taken great pride in their work so far. We have lots of problem spots that we know we'll have to address in the fall, but for now our yard is looking much better than it did a year ago.

- My point to all of this? Investors and advisors can do it themselves. They can do the research and probably do a good job --- for a time. Sooner or later there are going to be situations that come up that are brand new. They will misread a situation and rush to fix it, which will only compound the problem later. They also may get busy and not have the time to pay attention to their "grass" when it needs it the most.

- With SEM, you're not going to get a "lazy" landscaper. We've proven over the last two decades we will diligently monitor all facets of the market and act when appropriate. Who is monitoring your managers and investments on your platforms? Who has the experience of handling "unprecedented" events without flinching or panicking?

- I've seen many people discussing "home schooling". My favorite comment so far, "I'm now learning it wasn't the teachers problem when my child didn't get the work done." We are seeing a bit of that firsthand.

- Ironically, despite the new growth in the trees and working in the yard on Saturday, I still had worse allergies in Tucson. Our cars and deck furniture are literally coated in a light green dust, but so far so good. Given the glares you get when you cough in public, I'm glad.

- I finally left our 2 mile radius on Friday to go grocery shopping. Our goal is to get a week's worth of food (preferably two), but given how little of the necessities were on the shelves I'm not sure when that will ever be possible. For now, we'll have more "bratwurst spaghetti" and other creations we make with what is available on the shelves.

- Speaking of, it's the craziest things that run out, such as the K-cups we've used for a decade in our Keurig. As I joked on Facebook, is this how the settlers had to make coffee? We're still figuring out the formula, but if we can get it right we might have found a big budget item we can now eliminate. Who knew coffee could be this flavorful? (Actually I did, because I've been making cold brew coffee the past few summers and enjoy the taste so much more than hot coffee).

- One thing that I think is not being talked about enough -- our economy has relied far too much on China. Simple things such as elastic to make cloth masks at home cannot be found anywhere. Packaging for all kinds of products is made in China and that is often the reason for delay. Our quest for cheaper and cheaper stuff along with the pressure on corporations to maximize earnings led us to base too much of our economy on a communist nation. Hopefully coming out of this we'll change that. Given the cutbacks we've all made, this is the perfect time to fix it.

- While the three coronavirus stimulus bills so far have been necessary we are once again seeing small banks hurt and big banks profiting. The Payroll Protection SBA loans are not off to a good start. Originally they were going to roll into a 4%, 10-year loan. At the last minute the former Goldman Sachs banker and now Treasury Secretary pushed for 0.5% 2 year loans. That has since been upped to 1%, but small banks still cannot afford this low of a margin. Big banks are lending money, but only to customers who already have deposit accounts. Others are requiring a business account to lend the money. The banks also have to front the money, something the smaller banks cannot do, but the Wall Street banks, who are also primary dealers and thus beneficiaries of the unlimited "QE" programs implemented by the Fed are flush with cash. Another crisis, another big win for Wall Street.

- While Wall Street wins, the mortgage servicers are asking for their own bailout. The "forebearance" in the latest stimulus bill requires the servicers to front the money to the owners of the loans and then to request payment from the government. Turns out the servicers don't just have that much capital laying around and we've seen the refinancing and new mortgage market essentially frozen.

- Speaking of unintended consequences, an advisor asked me last week to look into a very big name fund that pretty much every advisor on every platform has been using. It was a bond fund who had outperformed all of its peers.....until March. It was down at one point 9%, far more than it had ever lost before. Upon investigation I found the fund was 190% long and 90% short. The short positions were interest rate and foreign currency swaps. The portfolio was over 50% mortgage backed securities. As I mentioned last week, the Fed's emergency actions has caused many hedges to blow-up -- moving in the opposite direction as they were intended. This fund and quite a few other "income funds" which were full of derivatives have suffered. Be VERY CAREFUL in fixed income. This isn't over by a long shot.

- It will be interesting to see what we all look like when the restrictions are finally lifted. I have curly hair that is cut every 4 weeks to keep it somewhat under control. The humid season here in Virginia is rapidly approaching. I was supposed to get a hair cut last Friday. Our governor has closed the state until at least the beginning of June.

- I did try to grow a quarantine beard. I made it 6 days. I just couldn't handle the itchiness or the disheveled look. I also was shocked by the amount of grey in those whiskers. Based on that, it's not too long before I see a noticeable change in my hair color.

- Remember when I wrote about the "Investment Grade Junk" market? I still firmly believe we are going to see massive defaults in that market. The Fed can't buy everything and we continue to see examples such as the last two points causing strains in the fixed income market. Be VERY CAREFUL in fixed income.

- For a long time I've mentioned municipalities as a major concern. I've warned about the unrealistic 7% assumptions used in government pension plans. I've warned about the huge amount of "investment grade" bonds in the portfolios of those pensions. I've warned about demographic issues causing more and more retirees to eat up the revenues due to the unrealistic promises made to workers in the 80s, 90s, and 00s. Now we have emergency spending using up all of the budget and revenues essentially grinding to a halt (minus sales taxes on groceries). I don't see how we don't have major defaults before this is all over in the municipal market. Be VERY CAREFUL in fixed income.

- If you've found our blog useful, please share it with your colleagues, friends, and family members. Unlike the big firms, our goal is to inform and educate. The big firms need you to stay invested, so their research will be slanted that way. We've set our investment models up to work regardless of market direction.

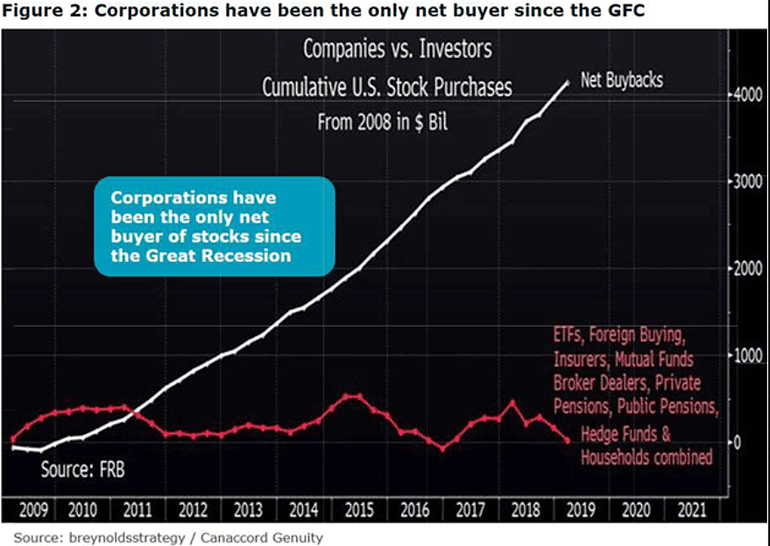

- One of the things that drove the market during the last 12 years has been stock buybacks. You've heard me criticize companies who borrowed money to buyback stock and pay dividends rather than investing in plant and equipment. We are now seeing restrictions placed on companies seeking bailout money on stock buybacks. This could be a problem during the recovery as corporations were pretty much the only net buyers during the last bull market according to this chart in John Mauldin's latest letter.

Finally, as I've said the last few weeks -- keep things in perspective. This too will pass and there will be plenty of opportunities on the other side for those who are prepared. There is no reason to rush. This is likely going to be a prolonged process.

Have a great week!